The names might be different but they all refer to the same thing: making payments securely with a device. Some of the most popular mobile wallets include Apple Pay, Google Pay, Microsoft Pay, and Samsung Pay, and contrary to what many people think, these payment methods are generally considered to be more secure than using a physical card to make purchases. Physical cards feature an identifying magnetic stripe, and information can be stolen from them rather easily if criminals tamper with a card reader by adding a skimmer.

A digital wallet — is even more secure than a chip card because it doesn’t use your actual card number for the transaction. As a security measure, your card information is only used in the initial setup of the wallet, helping increase mobile payment protection. Then, the device’s Wallet creates a token (think of it as a temporary card number) that is encrypted and used in place of your card number. The token number is not directly tied to your account, so even if someone were to hack into the merchant and break the token encryption, they wouldn’t be able to access your card or personal information. Additionally, the token isn’t a standard card number that could be used anywhere. It is specifically coded for each transaction, which makes it unusable beyond its intended transaction.

Mobile payment options also offer the added benefit of convenience, since everyone has their phone with them everywhere they go. Transactions via a device are frequently quicker as well. In one study, Apple Pay took just one second, while a card swipe lasted 12. That 11-second difference might seem trivial, but when you’re standing in a long line at a coffee shop or grocery store, that time makes a big difference. Digital Wallets can also be used for online or digital purchases, such as paid apps or subscriptions.

Mobile Pay can be used for both credit and debit cards and is one more step to no more bulky wallets.

As we continue to infuse technology with convenience, security will remain a forefront concern for individuals and businesses, especially concerning their financial information. That being said, mobile pay is arguably the safest and most dependable digital method for transactions today. Mobile payment protection technology will continue to evolve and strengthen with each new yearly iteration of device technology. Every day, more and more individuals are deciding to keep their debit cards in their physical wallets, and instead reach for their phone or tap their watches and use a safe mobile payment option.

It’s Easy to Enroll

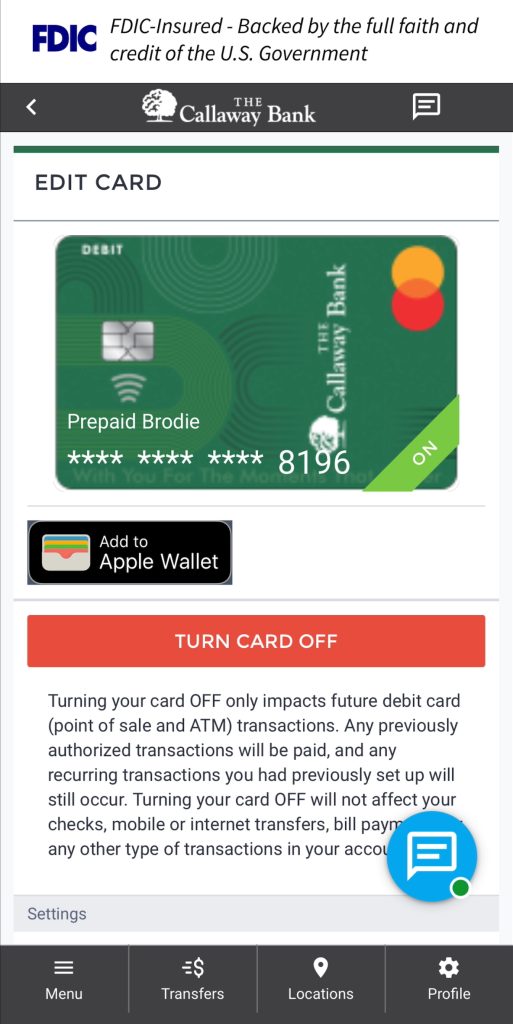

In the The Callaway Bank app, look for the “Add To” option in Digital Banking to enjoy instant Digital Wallet access for your watch and phone!

In Digital Banking > Manage Cards > Tap The Card You Want To Add!